This is what you need to know to trade today Thursday January 26:

US GDP remains stubbornly strong, as does the job market. The set of layoffs in the tech sector has yet to translate into jobless claims, and the Fed needs and wants unemployment to rise for inflation to come down. GDP growth is holding steady in the US and seems likely to avoid a recession in the first half of the year, if at all. Earnings season is progressing apace, and Tesla (TSLA) has been the latest to break records. However, companies are setting a much lower bar, and the outlook so far has been negative. On Friday we will see the PCE data, which will give us more clues about the next move by the Federal Reserve. So far, the market is pricing in a pause, but that pause may last much longer than expected.

The DXY dollar index it remains stable at 101.72, having broken above 102.00 with the data. The Prayed stands at $1,940, the Petroleum in the 82$ and the yields They rise, but are almost back to pre-GDP levels.

European markets rise 0.2%, except the Dax, which advances 0.4%.

US futures also risewith the Nasdaq up +1%, the S&P 500 up +0.6% and the Dow Jones up +0.35.

Top Wall Street News

The US GDP it is better than expected.

The unemployment benefit claims expectations improve.

Tesla (TSLA) beat profits, revenue is in line with expectations.

Top Reuters news

Comcast Corp CMCSA: The company’s fourth-quarter revenue exceeds Wall Street expectations.

Diageo Plc DEO: The world’s largest maker of spirits noted that strong demand for its beverages as people made expensive cocktails at home during the COVID-19 lockdowns may be slowing in some parts of the world, especially North America.

Dow Inc: The chemical giant missed Wall Street’s estimates.

IBM Corp: The company on Wednesday announced 3,900 layoffs as part of some asset divestments and missed its yearly cash target, dampening joy at beating revenue expectations in the fourth quarter.

Las Vegas Sands Corp LVS: The company presented quarterly results on Wednesday that were lower than Wall Street estimates.

Levi Strauss & Co LEVI: The denim apparel maker on Wednesday forecast annual sales above Wall Street estimates, betting on a stronger second half of the year despite rising costs and currency pressures clouding its near-term outlook.

Southwest Airlines Co LUV: The airline warned of a loss in the current quarter as passengers turned away from the company in the immediate aftermath of a technology meltdown that forced the cancellation of thousands of flights between Christmas and New Year.

Valero Energy Corp VLO: The refinery beat profit estimates.

Toyota Motor CorpTM: The CEO of the Japanese automaker will step down as head of the company his grandfather founded, Toyota reported.

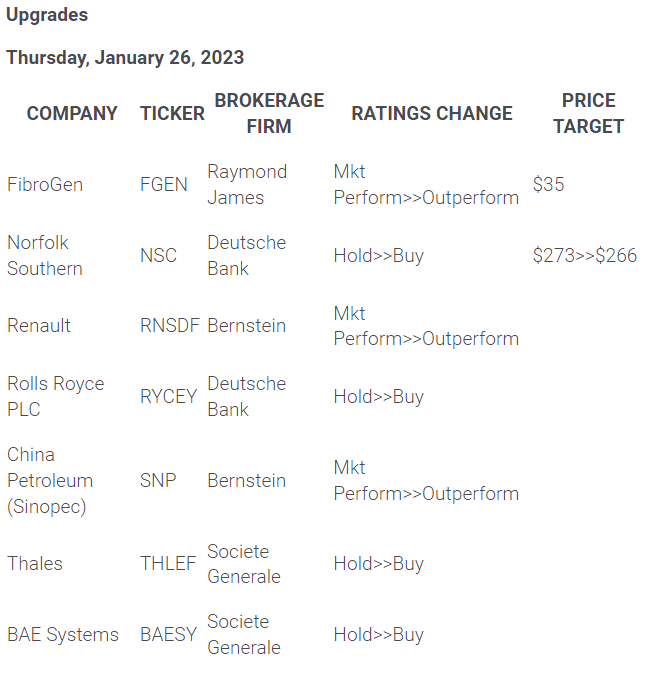

upgrades and downgrades

Source: WSJ.com

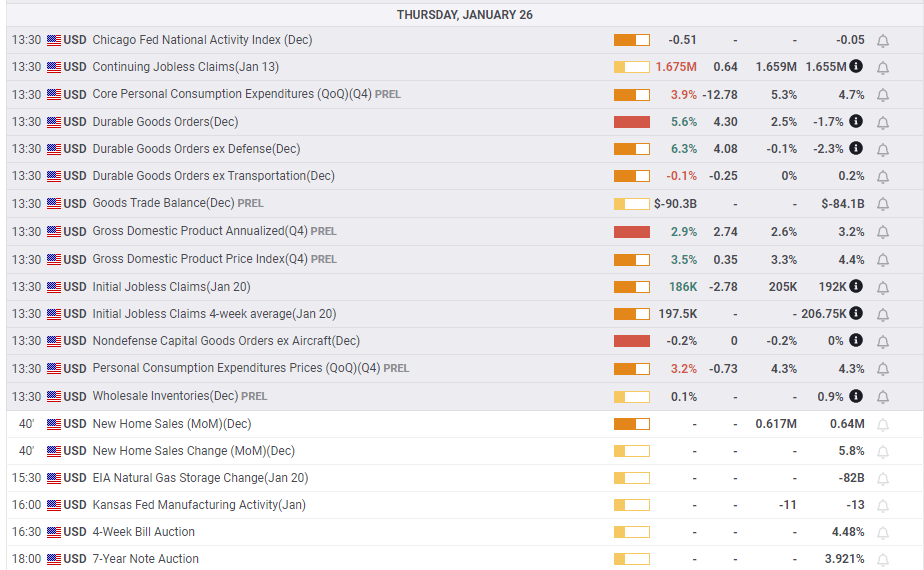

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.