Taking advantage of the recent rally and positive macroeconomic developments, crypto whales are actively accumulating some altcoins in hopes of making significant profits in November.

Coins that saw a surge in institutional interest this week included Ripple (XRP), FTT and ApeCoin (APE). If historical data is taken into account, the actions of whales could be the catalyst for a massive increase in the price of these tokens.

Crypto whales paid attention to FTT after Gary Gensler’s statements

This week, the price of the native token of the infamous FTX crypto exchange skyrocketed by 90%. The rise was driven by comments from US Securities and Exchange Commission (SEC) Chairman Gary Gensler, who responded to questions about a possible takeover “within the law.”

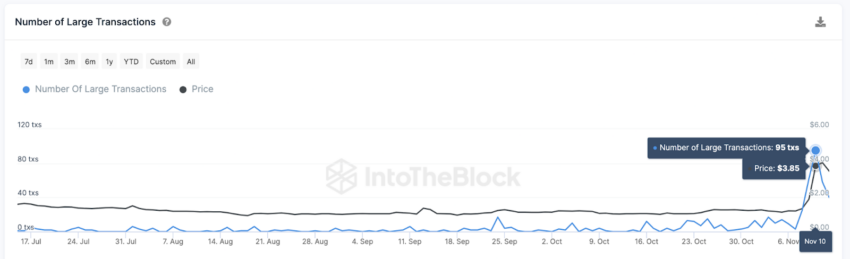

In the graph below IntoTheBlock shows that since Gensler’s remarks on November 9, the number of large FTT transactions has risen to a yearly peak of 95 transactions.

Although the token’s price is down 30% from last week’s peak, on-chain data shows that whales are still actively buying FTT, with retail investors keeping an eye on the asset in anticipation of further price gains.

Large investors prevented the fall of Ripple (XRP)

This week, the price of XRP fell to the critical support level of $0.65, and whales rushed to buy out the drawdown.

In the graph below Santiment It can be seen that in the period from November 12 to 15, addresses with a balance of 1 million to 100 million Ripple replenished their reserves by another 90 million tokens. At the current price of $0.66, the coins they purchased are worth about $60 million.

Such a significant influx of capital indicates that whales are expecting another price breakthrough. If they continue to buy, XRP could return to the $0.70 area in the coming days.

Fund inflows into ApeCoin (APE) have increased significantly

The price of the Bored Ape Yacht Club ecosystem’s native token ApeCoin (APE) fell to a record low of $1.02 in October. However, crypto whales were able to prevent further decline and provoked a rebound to $1.40.

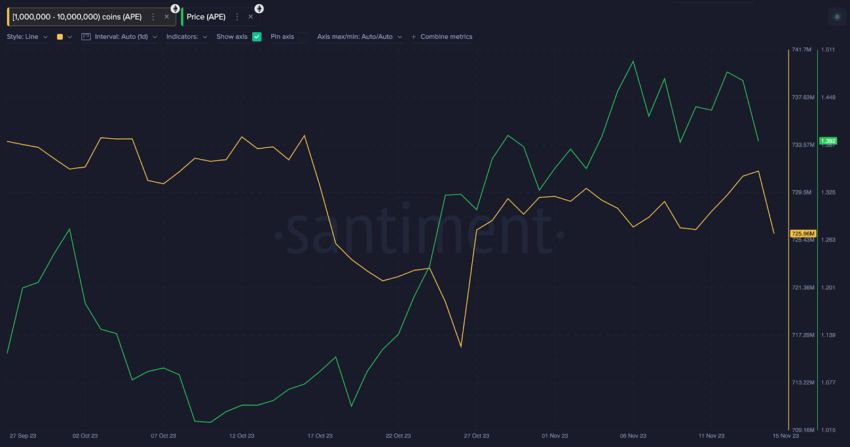

Data Santiment show that between October 26 and November 10, investors with balances between 1 million and 10 million ApeCoin increased their holdings by an additional 10 million tokens.

The price increase of 40% suggests that retail investors have followed the example of whales and switched to active purchases. Continued accumulation could put an end to concerns that the APE rate will reach a new all-time low.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.