Crypto community members are expecting an explosive growth in the rate of the second largest cryptocurrency by capitalization, Ethereum (ETF). The main driver of Ether’s positive dynamics could be the upcoming launch of spot ETFs for cryptocurrency.

We tell you what Ethereum forecast representatives of the crypto industry give and what levels of the coin, in their opinion, are worth monitoring.

What’s Happening with the Ethereum ETF

On July 9, 2024, issuers of spot Ethereum ETFs updated their applications. According to Bloomberg analysts, this move indicates readiness for the launch of the instrument on July 18.

Market participants have high hopes for the launch of spot Ethereum ETFs. For example, Galaxy Digital believes that the instrument will attract $7.5 billion in the first six months. Analysts at K33 Research, in turn, predict that against the backdrop of the launch of spot Ethereum ETFs, Ether will overtake Bitcoin in terms of profitability.

Despite the positive forecasts, ETH demonstrated negative dynamics in the run-up to the expected approval of the instrument, which hurt many investors. For example, the founder of the Tron crypto project Justin Sun lost $66 million amid Ethereum’s fall to a five-month low in early July 2024. The “smart money” responded to the decline of Ether by selling the coin.

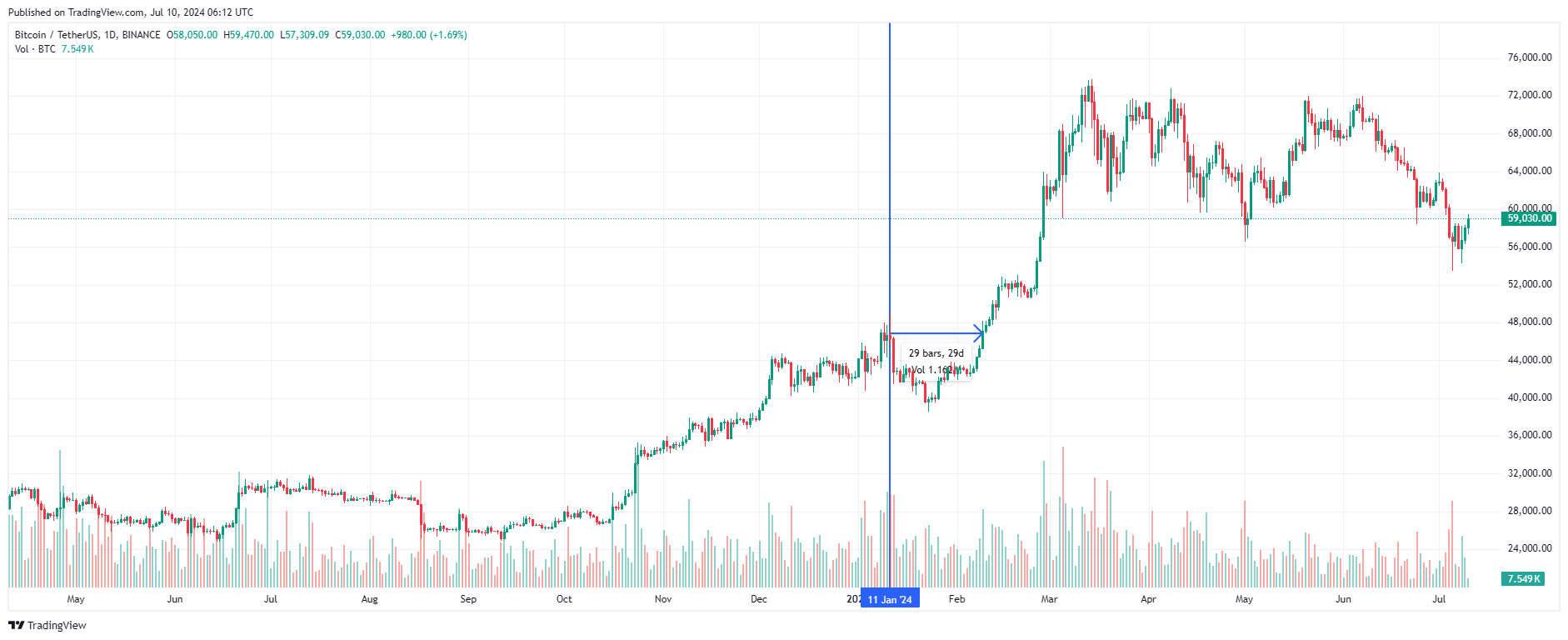

Bitcoin was actively growing ahead of the launch of spot BTC ETFs in the US. However, after the instrument was launched on the market, the cryptocurrency demonstrated negative dynamics. It took Bitcoin almost a month to recover to previous levels. The cryptocurrency came under pressure from the sell-off of the spot Bitcoin ETF GBTC from Grayscale, which the company built on the basis of its BTC fund.

The vertical line marks the day the spot Bitcoin ETF was approved in the US, the horizontal arrow marks the period it took for the BTC rate to return to its previous levels. Chart: TradingView

The vertical line marks the day the spot Bitcoin ETF was approved in the US, the horizontal arrow marks the period it took for the BTC rate to return to its previous levels. Chart: TradingView

The problem is that Grayscale has a similar Ethereum fund that it wants to transform into spot ETH for cryptocurrency in the same way. If history repeats itself, ETH risks being pressured by a sell-off.

However, many crypto community members believe that Ethereum will not follow in the footsteps of Bitcoin. In their opinion, the launch of spot Ethereum-ETFs, on the contrary, may trigger active growth of the cryptocurrency rate.

Ethereum Forecast

Trader @follis_ thinksthat Ethereum is on the verge of a phase of active growth. He compared the behavior of ETH with the movements of Bitcoin before the BTC pump at the end of 2023. If Ether repeats the trajectory of the capitalization leader, then the cryptocurrency rate, according to the trader, will be able to reach $7,000 by the end of the year.

With a similar forecast shared trader CryptoBullet. He also believes that ETH is on the verge of a rally.

With the view that Ethereum has growth potential, agreed analyst il Capo Of CryptoHe believes that the next couple of weeks will be extremely positive for the altcoin market.

To the supporters of positive forecasts analyst @TheMoonCarl joinsHe believes that the ETH chart shows a technical analysis figure called a “double bottom,” which indicates the cryptocurrency’s growth prospects.

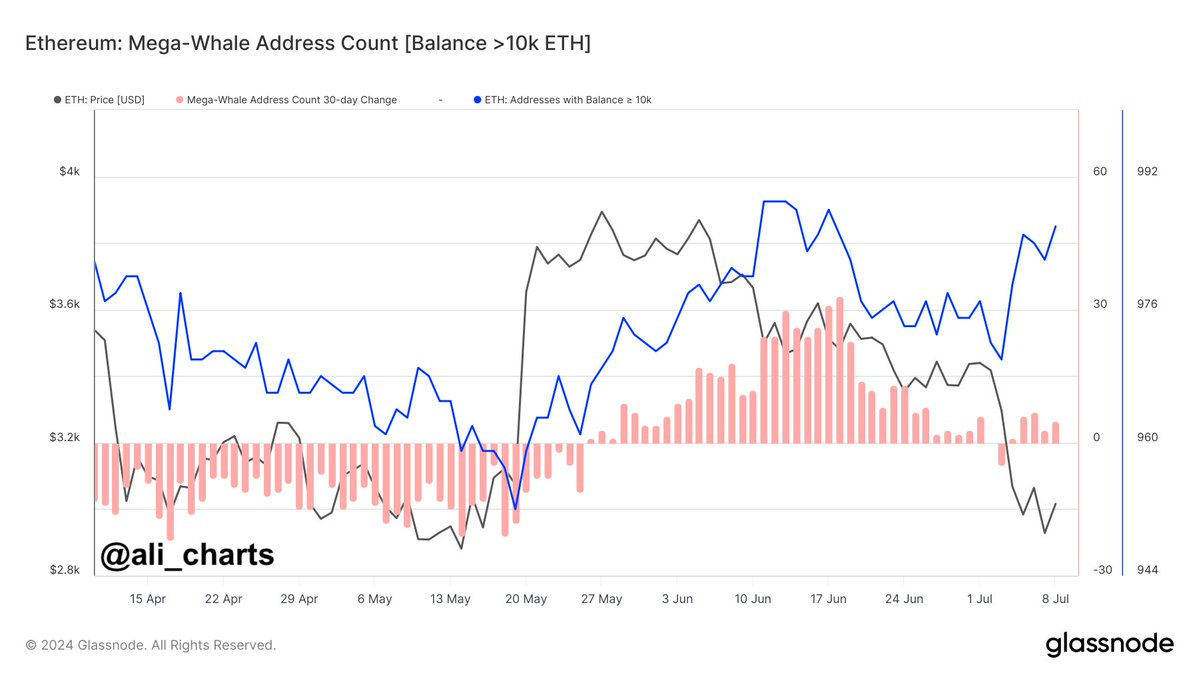

Large investors also seem to believe in ETH growth, as evidenced by the resumption of Ether purchases by whales.

Ethereum Whale Purchases. Source: GlassNode

Ethereum Whale Purchases. Source: GlassNode

Analyst Michael van de Poppe did not share Ether’s forecast, but notedthat cryptocurrency, according to his observations, looks stronger than Bitcoin.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.