The victory of Ethereum over the SEC forced members of the crypto community to once again pay attention to the second cryptocurrency by capitalization. Investors see at least 3 reasons for further growth of ETH.

We tell you what is happening with the coin and what forecast Ethereum is given by representatives of the crypto industry.

What’s happening with Ethereum

On June 19, 2024, reports appeared online that the US Securities and Exchange Commission (SEC) had suspended its investigation into the second largest cryptocurrency by capitalization, Ethereum. This was reported by representatives of Consensys, a software developer for ETH.

Let us remind you that Ether came under the SEC’s sights in the spring of 2024. The reason was the coin’s transition to the PoS algorithm. From the regulator’s point of view, such coins may be illegally issued securities.

Despite the claims against ETH, the Commission approved the launch of cryptocurrency-based spot ETFs in the United States. The Consensys team asked the SEC to explain why the regulator gave the green light to a tool that allegedly violates the law. The developers’ appeal was followed by news about the suspension of the investigation into Ethereum. At the same time, there is a clarification in official SEC documents that indicates the possibility of its resumption. Despite this detail, members of the crypto community perceived the news as a big victory for the digital asset industry. The fact is that other crypto projects will be able to use the Ethereum case to escape from the pressure of the regulator.

Ethereum reacted with growth to the SEC decision. During the day, the cryptocurrency rose by more than 5%, but then entered a correction. At the time of writing, ETH is trading at $3,568.

Against the backdrop of the positive dynamics of the coin, participants in the crypto community shared their forecasts.

3 reasons to buy Ethereum now

Many participants in the crypto community see potential for further growth in the cryptocurrency rate. Let’s look at what the positive forecasts are based on.

1. The capitulation of the SEC opened the way for Ethereum to grow. Many perceive news as an important victory for Ethereum, which will attract new investors to the project.

2. The launch of spot Ethereum-ETF trading will increase demand for the coin. The tool should appear on the market in early July 2024. It can be assumed that its launch, as was the case with Bitcoin, will support the growth of the cryptocurrency rate.

This is what the logic of such forecasts looks like: investors will begin to invest in Ethereum funds traded on the exchange, fund issuers will be forced to buy Ether, thereby pushing the coin’s rate up.

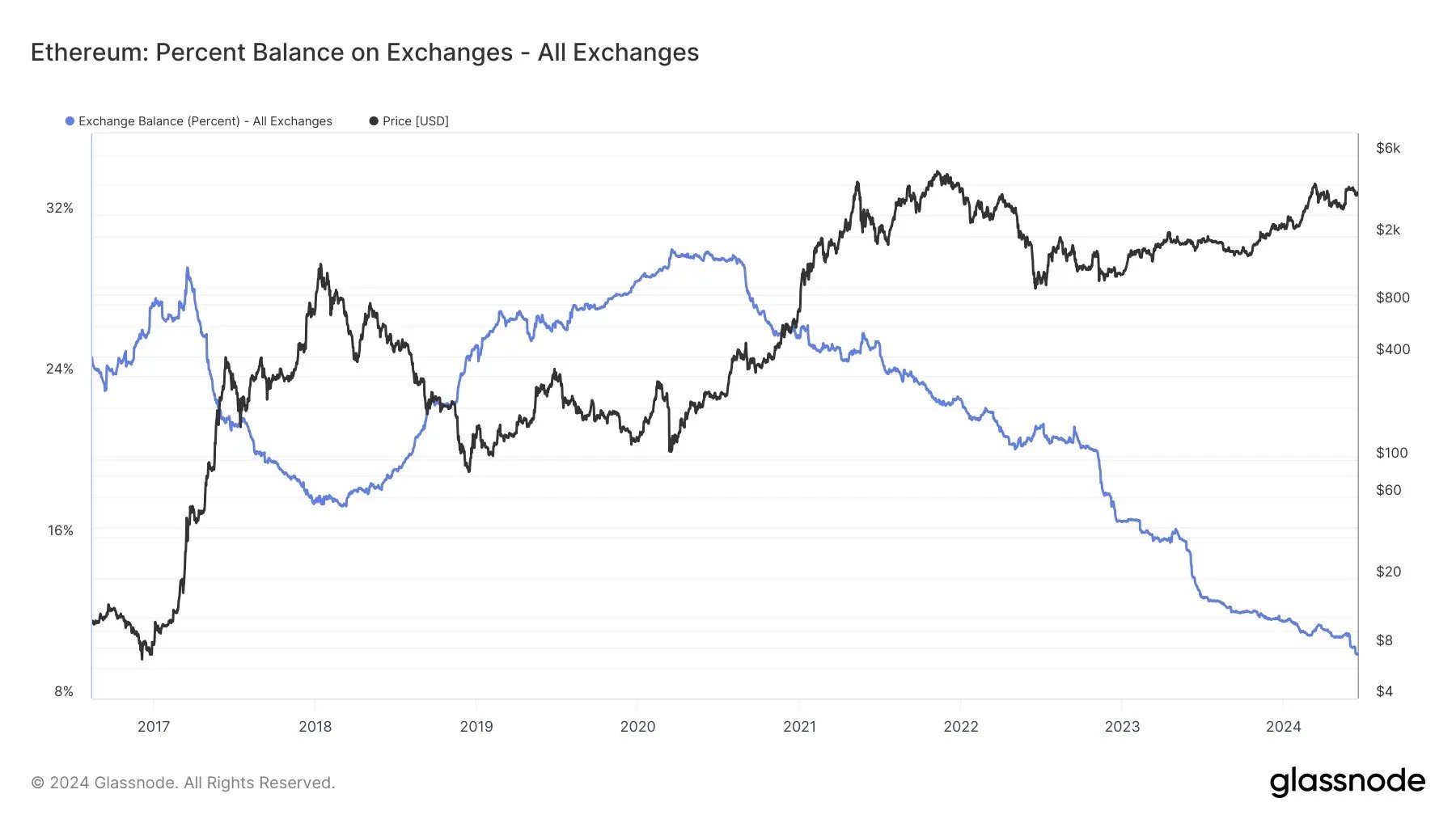

3. A shortage of ETH on exchanges will trigger a new rally for the coin. Popular investor in the crypto community @QuintenFrancois noticed on the drop in Ethereum volumes on exchanges to a minimum in eight years. In his opinion, against the backdrop of the launch of spot ETFs on Ether, the shortage of cryptocurrency could trigger a rally in its rate.

Ethereum balance on exchanges. Source: GlassNode

Ethereum balance on exchanges. Source: GlassNode

Many people believethat a combination of factors will lead Ethereum to new highs in the near future.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.