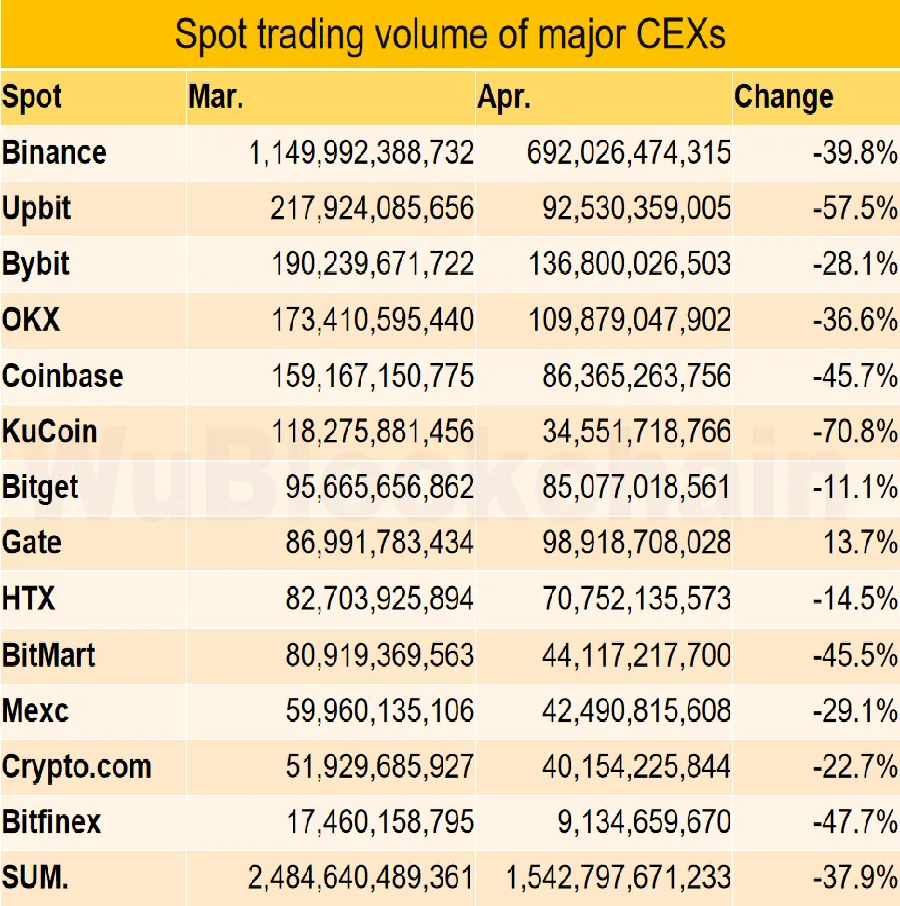

Spot trading volume on the largest crypto exchanges decreased by 37.9% month-on-month. The leaders in the anti-rating were: KuCoin with a decrease in spot trading volumes of around 70%, Upbit with 57.5% and Bitfinex with 48%.

Derivatives trading volume fell 50.7% on MEHS in April, 50.5% on KuCoin, and more than 38% on Deribit. The HTX and Crypto exchanges managed to achieve a less significant reduction in trading volumes in crypto derivatives. com and Bitget (on average about 14%).

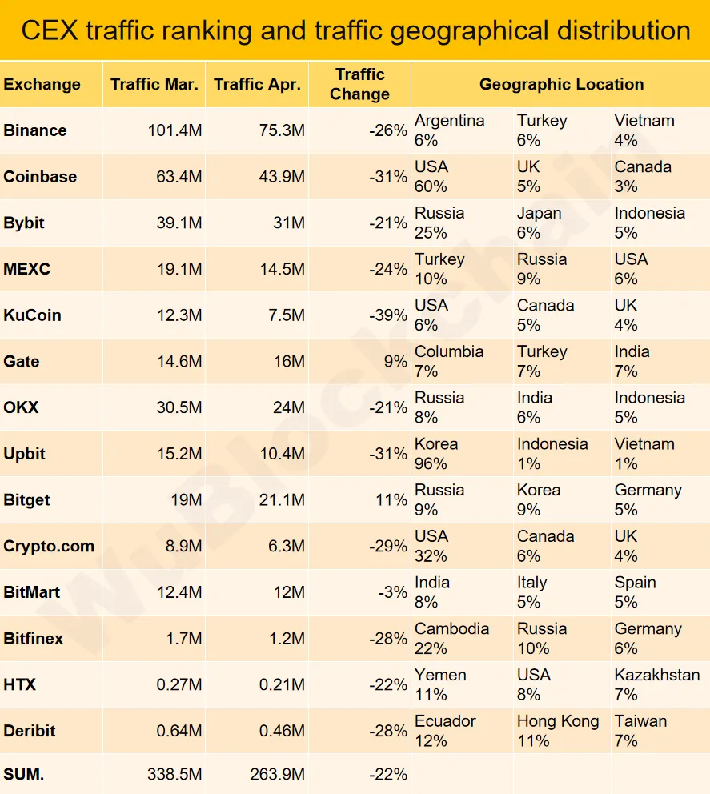

Against the backdrop of a general decline in interest in crypto assets, digital platforms recorded a drop in traffic to the websites of the largest exchanges by an average of 22%. User activity on the KuCoin exchange, for example, decreased by 39%, and by Coinbase and Upbit customers by 31%.

Analyzing the preferences of digital asset holders, Wublockchain notes that clients from the United States traditionally most often resort to the services of exchanges: Coinbase (about 60% of all visits in April), Crypto.com (32%), NTX (8%) and KuCoin ( about 6%). Upbit can be regarded as the most mononational crypto platform, with 96% of its clients living in South Korea.

The day before, the founder of the international fund Capriole Investment, Charles Edwards, said that, in his opinion, Bitcoin is in the “bored to death” stage, and the current period of asset consolidation will last for the next six months.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.