- Amazon’s actions fall 2% on Friday after exceeding the expectations of the fourth quarter.

- The projection of the first quarter for net sales and operational income did not impress.

- The gain per share of the fourth quarter of $ 1.86 exceeded consensus for 38 cents.

- Non -agricultural payrolls from the US in January were well below expectations.

Amazon (AMZN) More than 2% fell on Friday after the publication of the results of the fourth quarter on Thursday night. The e -commerce and data giant exceeded expectations for the quarter, but Wall Street dismissed the result due to a conservative projection for the first quarter.

In addition, the Amazon address awaits a strong wind against exchange fluctuations.

The market in general is more optimistic at the end of the week, since the non -agricultural payroll (NFP) of January fell, which leads to the early possibility of rates cuts by the Federal Reserve (Fed). The market still expects the Central Bank to maintain rates without changes in the March meeting, but the NFP of 143,000 in January, located well below the expectation of 170,000, at least they are caughting attention. However, the unemployment rate complicated the situation by falling slightly to 4.0%.

He Dow Jones Industrial Average (Djia)which includes Amazon as a component, opened slightly down but not much, while the S&P 500 and Nasdaq both saw slight profits.

News about Amazon’s profits

In the fourth quarter, Amazon won $ 1.86 in EPS GAAP, which is approximately $ 0.38 ahead of the Wall Street consensus. Likewise, the revenues of 187.8 billion dollars, an increase of 11% year -on -year, 560 million dollars arrived above the average forecast.

The great concern seems to be the projection of the first quarter for the current quarter. The management expects net sales of between 151.5 billion and 155,000 million dollars, while analysts had estimated $ 158,000 million.

In addition, the address foresees what it called an “unusually large” position for the change of foreign exchange of 2.1 billion dollars. They said this would reduce growth in at least 150 basic points.

A third reason for long faces was the operational income. The operational income of the first quarter was given in a wide range between 14,000 million and 18,000 million dollars. That midpoint, 16,000 million dollars, is only 1,000 million dollars above the same figure a year ago. Investors see it as a sign that the address realizes that its growth rate is stagnating. The operational income of the fourth quarter grew by 60% year -on -year compared to 2023, but the same figure in the first quarter is expected to increase less than 7% interannual.

Amazon Web Services or AWS, its cloud segment, represented approximately half of the operational income in the fourth quarter. AWS segment sales grew by 19% year -on -year up to 28.8 billion dollars.

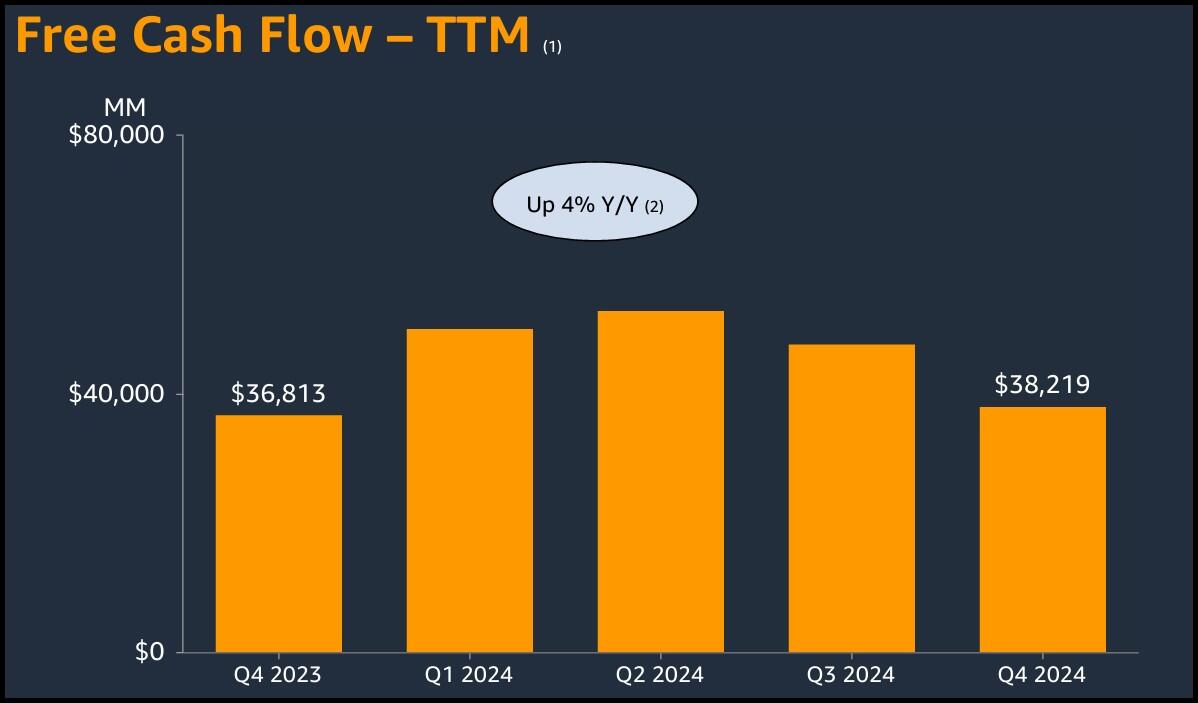

In addition, the free cash flow of the fourth quarter increased 4% year -on -year, but decreased substantially compared to the second and third quarter of last year.

Presentation of Amazon Quarter Fourth Earnings

Forecast and graph of Amazon actions

Amazon’s actions seem to need a setback. The green trend lines in the daily chart below demonstrate a clear divergence between the relative force index (RSI) and the price chart. This type of divergence normally leads to reversal.

The support is located in the minimum of January about $ 216.50 and the single mobile (SMA) of 100 days at $ 210. True correction would make AMZN actions go down to the 200 -day SMA about $ 196. If you think this is unlikely, you just have to know that Amzn has tried the 200 -day SMA in September before climbing 40% in the next four months.

AMZN Shares Daily Chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.