The largest American cryptocurrency exchange is going to offer investment products based on cryptocurrencies to funds whose assets under management reach a quarter of the continent's market.

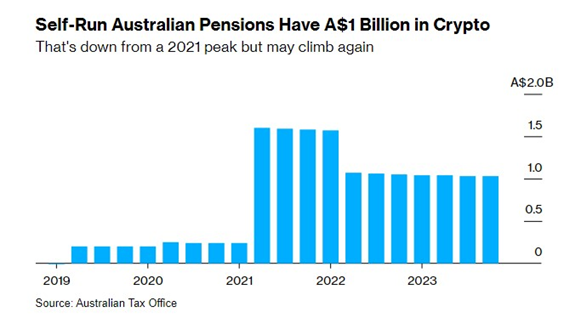

According to the Australian Taxation Office (ATO), the cryptocurrency assets of non-state pension funds are valued at $1 billion local dollars ($664 million).

Coinbase regional director John O'Loghlen said the exchange is seeing increased interest in virtual assets among Australian pension fund market participants.

BTC Markets CEO Caroline Bowler said Bitcoin is the most popular asset held by local pension funds. The local stock exchange ASX is going to allow trading in units of spot Bitcoin ETFs by the end of 2024. This means that the number of pension funds ready to work with digital assets will increase sharply, the CEO believes.

Earlier, the Coin ATM Radar service reported that Australia had risen to third place in the world in terms of the number of installed crypto ATMs.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.