On the night of March 15, 2024, the Bitcoin rate immediately fell to $66,700, according to TradingView. Later, the asset regained some of its lost positions.

At the time of writing, it is trading above $68,500 and is trying to gain a foothold above this level. There is high volatility in the market:

Note that the Bitcoin dominance chart also shows significant fluctuations. This figure decreased from 53.9% to 53.2%:

In addition, the total volume of liquidations on futures contracts amounted to more than $670 million in 24 hours. Most of the losses came from long positions, according to Coinglass.

The Bitcoin drawdown had an impact on the rates of other assets. Of the top 10 coins in terms of capitalization, eight are in the “red” zone:

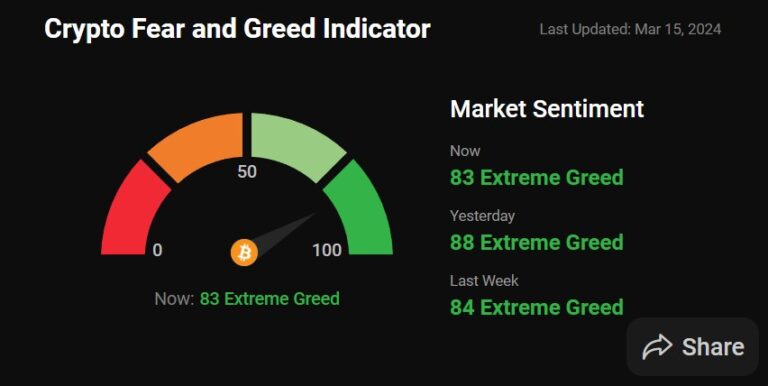

Despite the decline, investors appear to be optimistic. This is indicated by the index of fear and greed, which remains at 83:

Some analysts called the fall of the first cryptocurrency a natural phenomenon after a sharp upward trend.

However, the decline in Bitcoin is likely to be short-term, according to QCP Capital analysts:

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.