Large investors in the crypto community are called whales. Such market participants may have inside information and receive signals from experienced analysts. Many representatives of the crypto industry track the activity of large investors in order to make money by repeating their actions. CryptoQuant CEO Ki Yong Ju noted that whales, including, managed to prepare for the growth of the crypto market at the end of 2023. Observations about what steps large investors took, he shared in your microblog.

According to Ki Yong Ju’s observations, whales began to open the bulk of long positions at the moment when BTC reached $29 thousand. The accumulation phase, according to his observations, started in early August 2023.

At the same time, many whales, according to his observations, began to enter the market when BTC reached a cyclical low against the backdrop of the collapse of the FTX crypto exchange in November 2022. This, in his opinion, is indicated by the increase in cryptocurrency transfers to derivative trading platforms during the indicated period.

A surge in whale activity in the United States occurred in October 2023. This is indicated by an increase in markups on the Coinbase premium index and assets on the Chicago Mercantile Exchange (CME).

Retail investors according to his observations, have not yet entered the market. In such conditions, the supply of BTC may not keep up with the demand from large investors, which means whales are unlikely to get rid of their coin reserves.

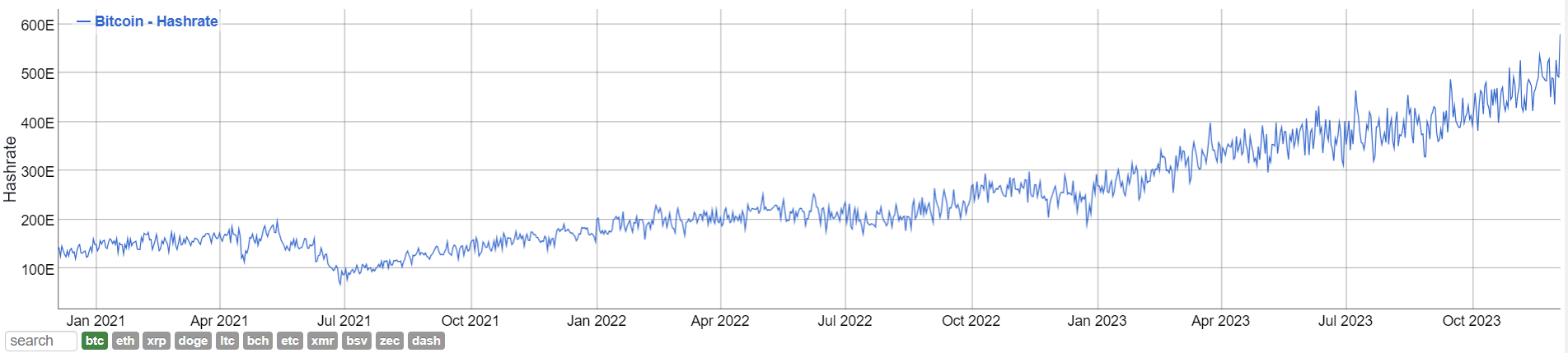

Meanwhile, miners, including large crypto mining companies, continue to purchase equipment. As of the time of writing, the hashrate (the total amount of computing power connected to the BTC network) is at an all-time high.

According to Ki Young Joo’s calculationsafter halving 2024, the average cost of mining one bitcoin will be about $36 thousand. The increase in the hashrate indicates the miners’ belief that the coin rate after the event will be higher than the designated level.

The majority of the market is occupied by private mining companies. The growth in hashrate also indicates the faith of large investors in the further rise in prices in the digital asset market.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.