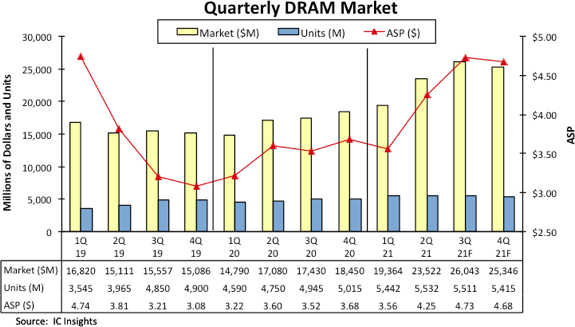

DRAM prices rose 41% in the first eight months of 2021. However, in September, the average selling price of DRAM dropped 3%. Strong growth and market bounce was expected in 2020 after a very difficult 2019, when the average selling price of DRAM fell by 44%. But problems, chief among which was the COVID-19 pandemic, interfered with the behavior of the DRAM market in 2020.

In 2021, some regional economies began to recover. During the first three quarters of the year, DRAM vendors struggled to meet pent-up demand across all end-use segments. Shipment times were stretched as buyers looking to have enough chips in stock for their systems placed additional orders, which spurred price increases.

Specifically, PC and server makers purchased large quantities of DRAM in the first half of 2021 to offset possible supply delays in the second half of the year, which has traditionally seen a seasonal pickup in demand. They are expected to cut DRAM purchases in the fourth quarter to use up inventory. As a result, PC and server DRAM prices will drop 0.5%.

The situation is similarly unfolding in the mobile DRAM segment.

In the graphics memory segment, purchases will also be lower, but for a different reason. An acute shortage of driver chips, power management chips, and other peripheral chips will restrict graphics card production, causing manufacturers to reduce order volumes and drop the price of graphics DRAM by 0-5%.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.