The month of July should register an inflation of -0.5%, driven by the fall in the prices of gasoline and electricity. The projection is by the coordinator of the Consumer Price Index at Fundação Getúlio Vargas (FGV), André Braz.

If confirmed, it would be the biggest deflation since August 1998, when the rate was -0.51%, according to the historical series of the Brazilian Institute of Geography and Statistics (IBGE).

After a National Consumer Price Index (IPCA) of 0.67% in June, the slowdown, according to Braz, is mainly caused by the reduction of the Tax on Circulation of Goods and Services (ICMS).

Limiting the rate to up to 18% in the energy and fuel sectors, through a national law, caused electricity bill prices and especially gasoline prices to fall.

However, the FGV economist draws attention to the fact that the ICMS effect should be punctual, absorbed in this month of July and, to a lesser extent, in August.

“The tax reduction is here to stay, so there is this drop and that’s it. And we still see great persistence [da inflação] in food. The diffusion index should come in well above 60%, almost there at 70%. You will see deflation, with a high diffusion index, the one that shows the percentage of products and services in the consumption basket of families that have increased in price”, he pointed out.

Braz also highlights that deflation should not be felt by low-income families, whose consumption is based on food, whose prices should continue to rise, after inflation of the category of 0.8% in June.

“The most curious thing is that this ICMS issue does not serve the low-income population because the poor do not put gas in their car, nor do they have a car to put gas in. And the poorest families also use a volume of energy that, before this ICMS change, was already taxed at up to 18%”, highlighted the coordinator of the FGV Consumer Price Index.

For August, André Braz predicts another possible month of deflation due to fuel effects, with drops announced by Petrobras in gasoline and diesel prices, not fully captured by the IBGE in July.

For the year, the economist projects an inflation of 7.2%, but highlights that the economic scenario is experiencing a series of uncertainties, which can change factors from one moment to another. He assesses that inflation, which registered, in June, an accumulated 11.89% in 12 months, should fall due to commodity prices and also the chain effect of the reduction of electric energy, which impacts from industrial production to for sale in supermarkets.

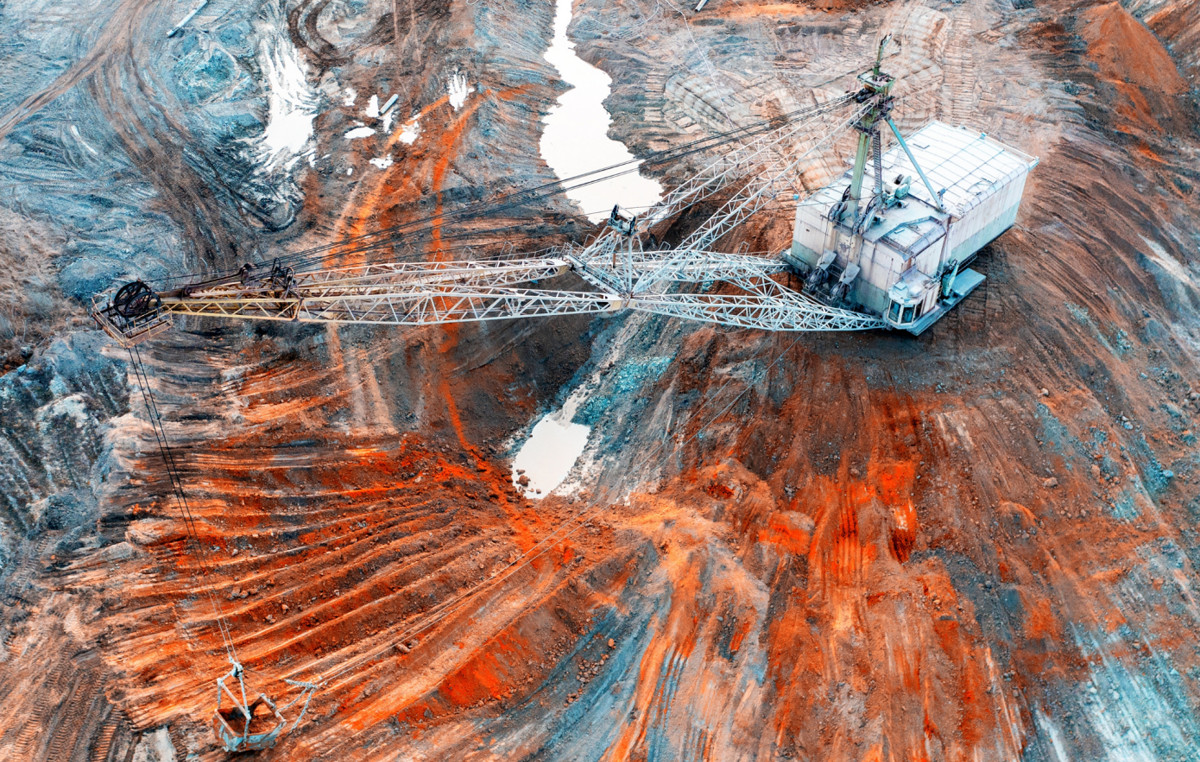

“For now, as the world is putting one foot into recession, this has typically cooled the price of many agricultural and mineral commodities. Iron ore, corn, soybeans, wheat, in response to this risk of recession and weaker demand as a result, are already starting to show a drop in price. This could cause inflation to slow more than we can anticipate at the moment,” he declared.

But Braz recalls that the reduction of inflation must be accompanied by incentives for economic activities. The economist highlights that the government will have the challenge of heating up the scenario, especially in 2023, even in the face of approved tax waivers, which should impact revenue and, consequently, the resources available for investments.

“We not only need to control inflation, but also generate employment. Without a job, families have no income. What good is low inflation and families with no money to buy?”, she put it.

Source: CNN Brasil

I am Sophia william, author of World Stock Market. I have a degree in journalism from the University of Missouri and I have worked as a reporter for several news websites. I have a passion for writing and informing people about the latest news and events happening in the world. I strive to be accurate and unbiased in my reporting, and I hope to provide readers with valuable information that they can use to make informed decisions.