- Adobe Systems presents a gain of 2.37% on the day, in line with Automatic Data Processing, which registers a profit of 1.88%, daily.

- US Non-Farm Payrolls surprise the market by registering 272,000 in May, well above the 185,000 expected.

The Nasdaq 100 marked a daily low of 18,903 during the American session, finding buyers that led the index to reach a daily high of 19,102 during the American session. At the time of writing, the Nasdaq 100 is trading at 19,110, gaining 0.47% on the day.

Adobe Systems (ADBE) and Automatic Data Processing Inc (ADP) are trading with profits today

Adobe is trading at $468.12, gaining 2.37% daily. Automatic Data Processing Inc, trading at $324.38, registers a profit of 1.88%, daily. Mizuho Securities lowered Adobe’s price target to $640 from $680. Deutsche Bank maintains a buy rating on Adobe despite seeing competitive pressures and low monetization in its AI product offering.

Non-Agricultural Payrolls have exceeded expectations, registering 272,000 new jobs in May, compared to the 185,000 expected. Annual salaries show a growth of 4.1%, compared to the previous 4.00% and the expected 3.9%. The rise in wage inflation may lead the Federal Reserve to rule out a rate cut in the short term.

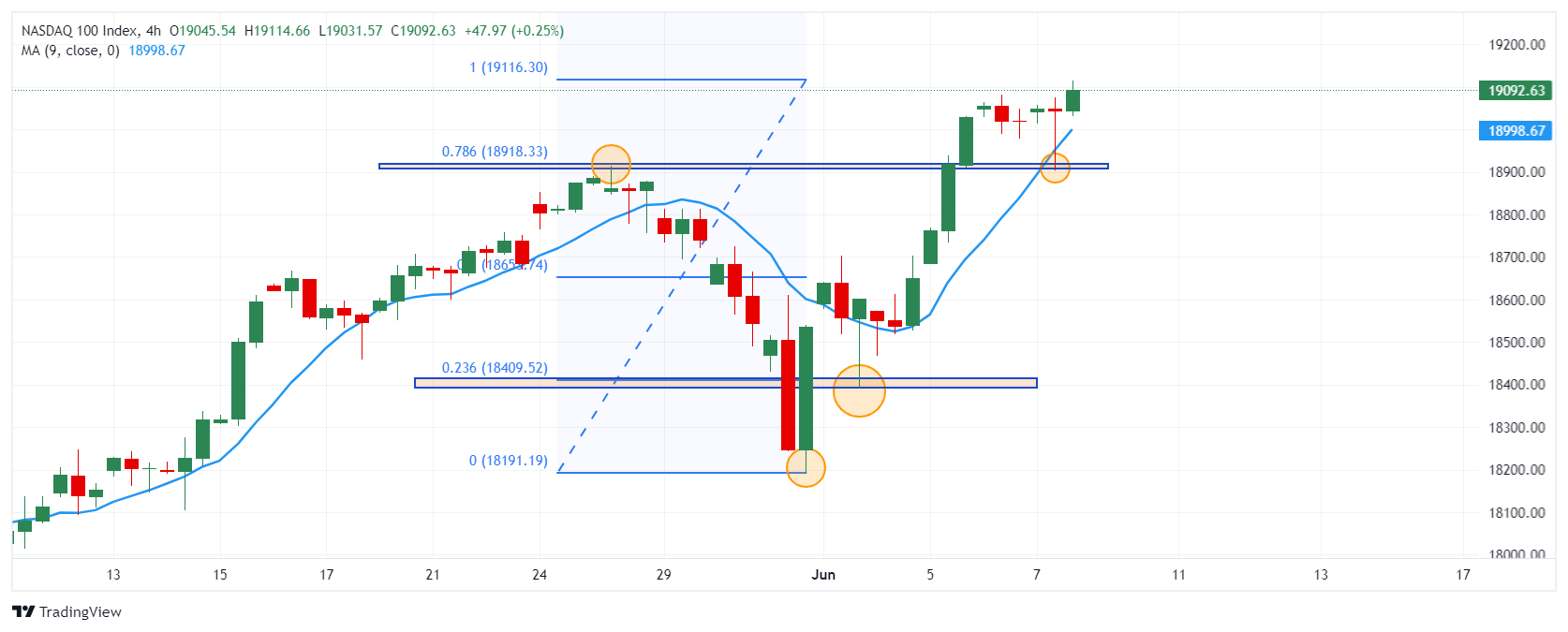

Technical levels on the Nasdaq 100

The Nasdaq 100 is in a clear upward trend, identifying the first support at 18,900, a closed number that converges with the 78.6% Fibonacci. We see the next support at 18,400, given by the minimum of June 3, in confluence with the 23.6% Fibonacci retracement. The nearest resistance is at 19,600, projection at 161.8% Fibonacci.

Nasdaq 100 4-hour chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.

![News and prognosis of the price of the pound sterling: the GBP/USD earns even when the unemployment rate in the United Kingdom is accelerated [Video] News and prognosis of the price of the pound sterling: the GBP/USD earns even when the unemployment rate in the United Kingdom is accelerated [Video]](https://editorial.fxsstatic.com/images/i/gbp-usd-001_Large.jpg)