Key points

-

Tesla shares have now completed a 10-day winning streak.

-

This appears to be a pattern for EV makers, with other brands also on the rise.

-

We examine what this means for investors.

Tesla shares rose nearly 4% on Tuesday versus a 0.03% gain for the S&P 500, completing a 10-day winning streak for the automaker, its longest since June 2023.

Tesla’s rally appears to represent a pattern in the electric vehicle (EV) space. Most notably, Rivian shares are up more than 11% since the end of trading last week, boosted by a new partnership with Volkswagen.

Similarly, Lucid Group has added more than 8% to its value since Friday’s close, while Polestar’s share price has risen 7% over the same period.

But as EV stocks show signs of recovery, investors will be watching closely to see if the bull run continues beyond the upcoming second-quarter earnings season.

Electric vehicle stocks gain traction

Following its latest gain on Tuesday, Tesla shares have risen nearly 44% over the past 10 trading sessions, adding about $250 billion in market cap. The stock has outpaced the Automobiles-Tires-Trucks sector’s 16% gain and the S&P 500’s 4% gain over the same period.

Before this 10-day rally, Tesla shares were down 27% year-to-date, but are now up nearly 6%. The stock has soared amid stronger-than-expected second-quarter electric vehicle deliveries and battery storage deployments.

Other electric vehicle stocks have also been gaining lately. Rivian, for example, has gained 31% since Volkswagen’s $5 billion investment was announced last month. The deal will provide much-needed cash to the company to ramp up its production.

Rivian’s announcement of second-quarter deliveries of nearly 13,800 vehicles, representing a 9% year-over-year increase, has also boosted its shares of late.

Luxury sedan maker Lucid Group has also seen some relief lately after struggling badly since going public in 2021. On Monday, the company reported second-quarter deliveries of 2,394 vehicles, a 22% jump from the first quarter and a 70% year-over-year increase.

Lucid shares are up 18% since early July and nearly 40% since hitting a 52-week low in April of this year.

Chinese electric vehicle and battery giant BYD has also been seeing success lately, with record second-quarter sales of nearly a million earlier this month. BYD shares are up nearly 10% at the yearly high and more than 14% over the past three months.

Swedish manufacturer Polestar also announced a significant jump in deliveries between the first and second quarters. Polestar’s ADR has risen by almost 22% in one month.

Electric Vehicle Stocks – Are They Risky?

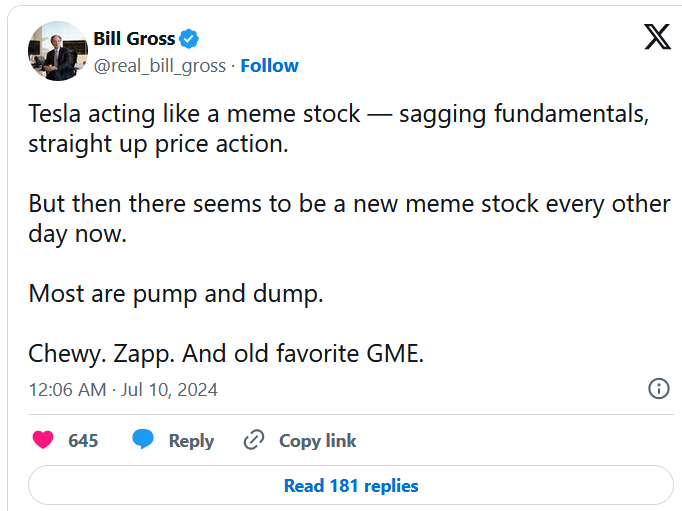

In a recent post on X, legendary bond manager Bill Gross pointed out that Tesla is behaving like a meme stock, referring to Tesla’s ongoing rally. The financial expert warned that gains in the stock are not justified as the EV maker has “declining fundamentals.”

Gross compared Tesla’s stock to other pump-and-dump stocks like Chewy, EV maker Zapp and GameStop. Chewy’s stock gained 36% in late June after Keith Gill, known for his involvement in the GameStop short squeeze, tweeted a photo of a dog.

Zapp shares have gained nearly 500% in the past three days, while GameStop shares have gained more than 200% since Gill returned to social media in May.

Gross’ statement about Tesla stock may or may not be true, but we do know that the company has been struggling due to increasing competition and the growing popularity of hybrid cars. It’s not just Tesla; many other EV makers are experiencing similar issues as well.

The performance of the auto-tire-truck sector highlights this well. The sector has returned -20% over the past three years, similar to what Tesla stock has returned over the same period.

What should investors do?

There’s no denying that many EV manufacturers have struggled with demand in recent years.

On the other hand, the latest delivery numbers suggest that demand for electric vehicles is stabilising globally and the market is recovering. Moreover, analysts believe that increasing affordable offerings would boost volumes this year and beyond.

However, with most major manufacturers expected to report earnings soon, investors should look for more positive signals for the market and make their investment decisions accordingly.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.