Participants in the crypto community started talking about the risks of delisting the most capitalized stablecoin, Tether (USDT), from the largest crypto exchanges. The reason for the publication of such messages was the release of new guidelines for the listing of cryptocurrencies by the New York financial regulator.

One of the first to discuss the risks of delisting a stablecoin from major exchanges spoke Doctor Profit, a popular trader in the crypto community.

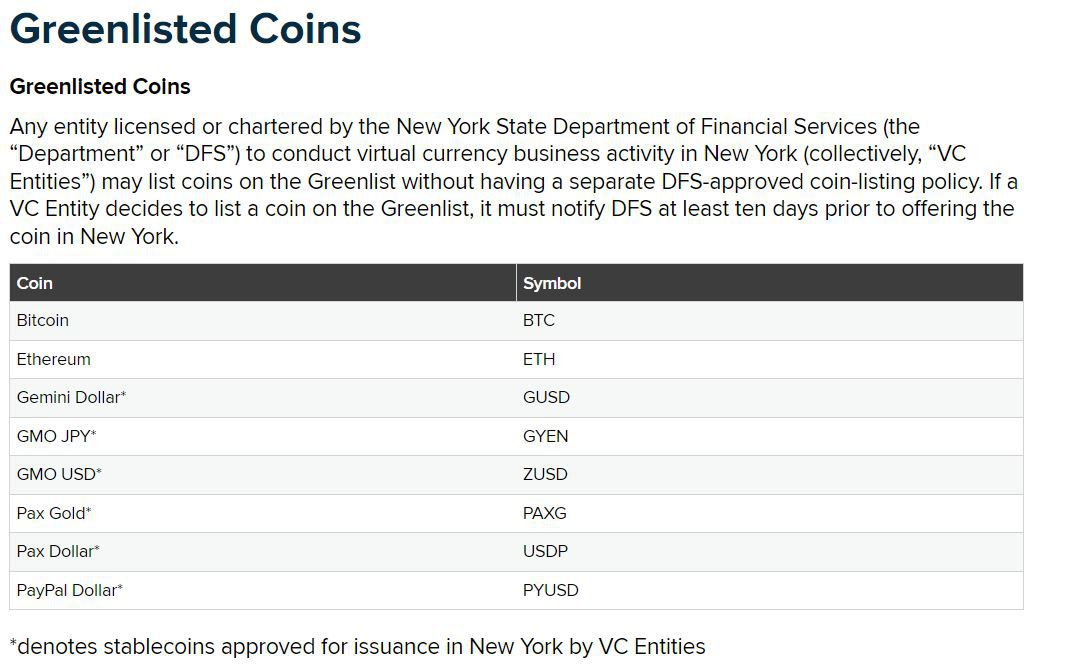

In response to a question about why he thinks so, Doctor Profit referred to new token listing guidelines New York State Department of Financial Services (NYDFS). It, among other things, contains a clause on stablecoins. Here’s what it says: “Venture companies cannot independently certify stablecoins that are not included in the green list.”

As of the time of writing this review in “green list» no cryptocurrencies USDT. However, it does have other stablecoins, including PayPal Dollar (PYUSD). Let us recall that in November 2023, the company issuing the “stable coin” received a subpoena from the US Securities and Exchange Commission (SEC).

NYDFS Crypto Green List

NYDFS Crypto Green List

The “green list” also does not include the second largest stablecoin by capitalization – USD Coin (USDC), which Circle released jointly with the Coinbase crypto exchange. Therefore, it can be assumed that restrictions may also affect this token.

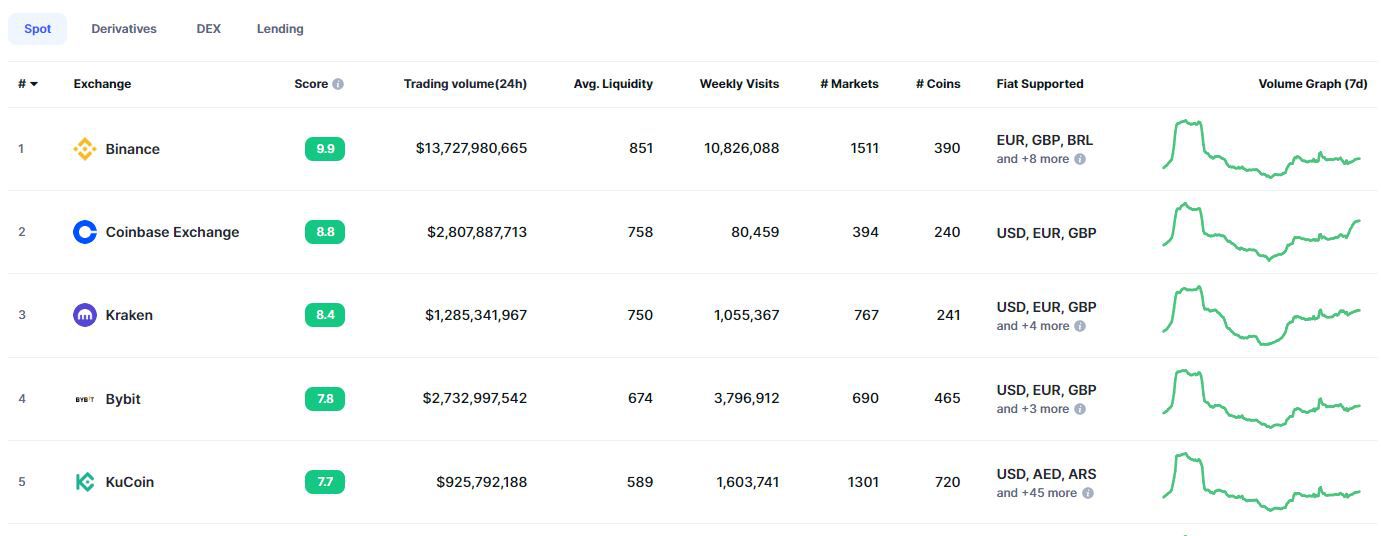

Market participants are waiting for the delisting of the stablecoin from crypto exchanges that do business from the United States. That’s why, as representatives of the crypto community think, market leaders such as Coinbase and Kraken will be the first to be hit. Both platforms are among the top 5 largest crypto exchanges by total trading volume.

Top 5 largest crypto exchanges on spot. Source: CoinMarketCap

Top 5 largest crypto exchanges on spot. Source: CoinMarketCap

On both exchanges, Tether is a leader in terms of trading volume.

Doctor Profit believesthat despite the blow that the delisting of a stablecoin could cause to the market, USDT will not lose its peg to its underlying asset, the US dollar.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.