- The US dollar moves sharply on the board of the main crosses against other currencies.

- The president of the USA, Trump, pauses the tariffs to Mexico and Canada while China takes reprisals.

- The US dollar index (DXY) tries to stay above 108.00 while looking for direction through the headlines on tariffs.

The American dollar index (DXY), which tracks the performance of the US dollar compared to six main currencies, is having a difficult Tuesday, reaching 109.00 before going back to the lower level of 108.37. The DXY quotes around 108.50 at the time of writing. The markets are reacting to a mixture of headlines with a sigh of relief from Mexico and Canada, which saw the imposition of US USA tariffs. Meanwhile, China has retaliates against the tariffs of the US president, Trump, issuing his own levies on goods imported from the US.

The economic data calendar is taking shape in the race towards the data of non -agricultural payroll on Friday. The US Jolts employment offers report will be published later in the day and could give more information about the stiffness of the labor market. In addition, two speakers of the Federal Reserve (FED), the president of the Fed of Atlanta, Raphael Bostic, and the president of the Fed of San Francisco, Mary Daly, will speak and could leave comments for the markets to consider.

DIAREST OF THE MARKET MOTORS: Tariff fog

- China announced on Tuesday a 15% tax on less than 5,000 million dollars in US energy imports, such as liquefied coal and natural gas (LNG), and a 10% rate of oil and US agricultural equipment, And he will also investigate Google for alleged antitrust violations, Bloomberg reports. Meanwhile, Canada and Mexico are seeing the tariffs imposed by the US, thanks to their actions to comply with the US President Donald Trump.

- At 15:00 GMT, the monthly factory orders of December are expected. A new fall of -0.7% is expected from -0.4% of the previous month.

- At the same time, the Technometric and Political Institute (TIPP) will publish its monthly reading of economic optimism for February. Consensus is an increase to 53, since 51.9.

- The US Jolts employment offers will also be published for December. A small decrease to 8 million job offers is expected, from 8,098 million in November.

- The Federal Reserve also has two scheduled speakers:

- The president of the Fed of Atlanta, Raphael Bostic, will moderate a conversation with the mayor of Atlanta, Andre Dickens, at a meeting of the working group on the national housing crisis in Atlanta at 4:00 p.m. GMT.

- The president of the Fed of San Francisco, Mary Daly, will participate in the Walter E. Hoadley Annual Economic Forecast Panel, organized by the Commonwealth Club World Affairs in California at 7:00 p.m. GMT.

- The actions are in red, unable to find a clear direction, having difficulties to digest the series of headlines on tariffs.

- The CME Fedwatch tool projects an 86.5% probability of maintaining interest rates without changes in the next Fed meeting on March 19.

- The 10 -year bonus of US bonus quotes around 4,575%, above its new annual minimum of 4.46% seen Monday.

Technical analysis of the US dollar index: movements and counter -ribbonations

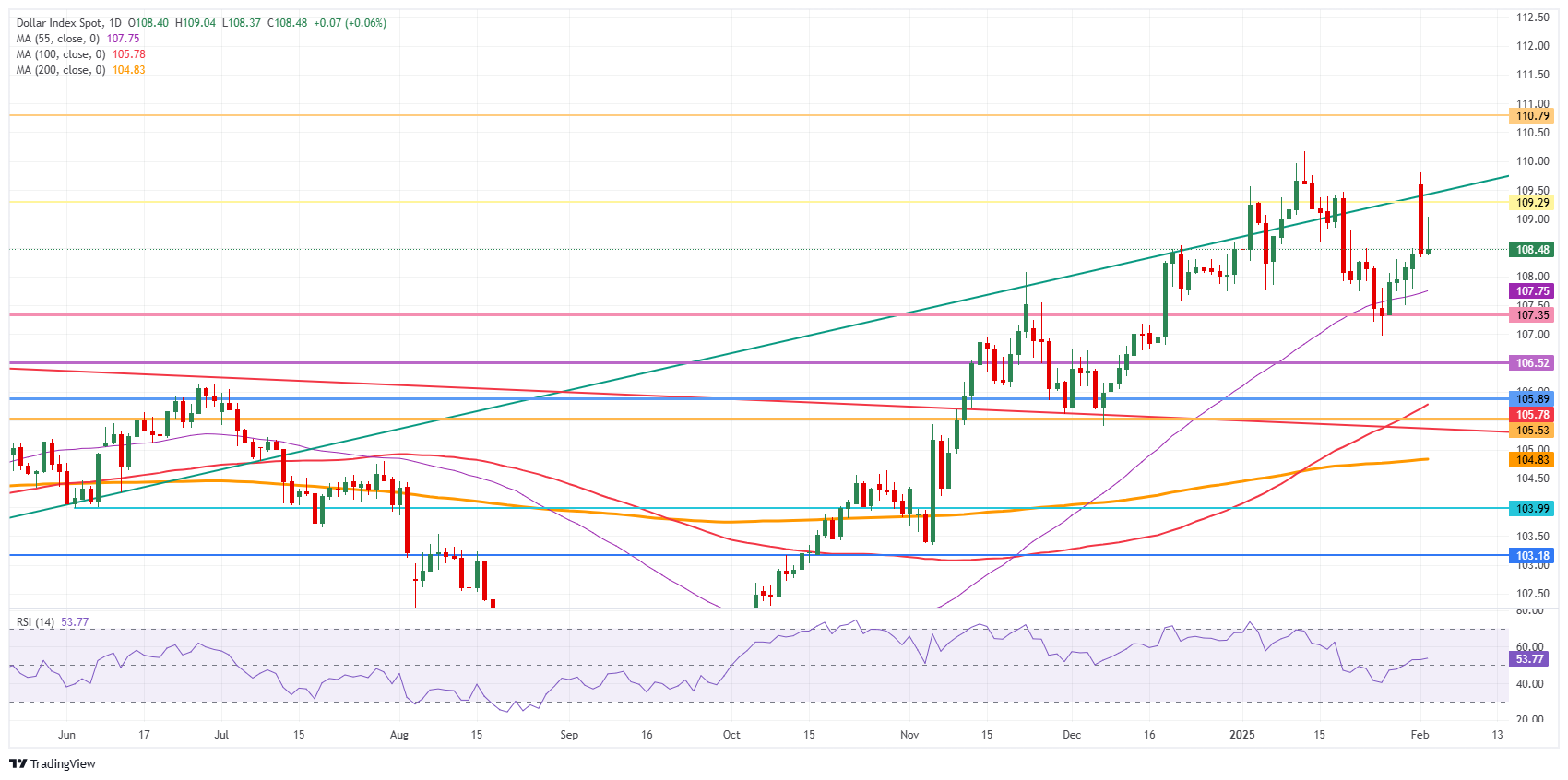

The US dollar index (DXY) is everywhere, although when you get away, it doesn’t really go anywhere. A range is defined as 107.00 down and 110.00 up. Wait to see the DXY keeping the trade in the range between these two larger levels for now.

Upwards, the first barrier in 109.30 (maximum of July 14, 2022 and a line of ascending trend) was briefly overcome but did not remain on Monday. Once that level is recovered, the next level to be reached before progress is still 110.79 (maximum of September 7, 2022).

Down, the simple mobile average (SMA) of 55 days in 107.75 and the maximum of October 3, 2023 in 107.35 act as a double support for the price of DXY. For now, that seems to be maintained, although the relative force index (RSI) still has some space for decline. Therefore, look for 106.52 or even 105.89 as better levels.

Dollar index: daily graphic

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.