The Turkish pound has recovered strongly from near-historic lows earlier in the day, as the central bank said it had intervened due to “unhealthy” market prices.

The pound’s volatile path to a low-liquidity market came after the Turkish currency plunged in November. The pound fell to about 30 percent in November, the second-worst in history, and was forged by support for President Recep Tayyip Erdogan in a major monetary easing amid rising inflation and widespread criticism.

The central bank – which Erdogan reshuffled and pushed this year – said in a statement that it had intervened “directly” in the market “with sales due to unhealthy exchange rates”.

The Turkish currency, which had previously fallen 3.3% to 13.87 pounds per dollar, recovered to 12.76 pounds at 11.36 (Greek time), rising more than 5% per day. It sank to a record low of 14 pounds on Tuesday as Erdogan defended his fiscal policy and the dollar benefited from US central bank officials’ statements in favor of a tightening policy.

The Turkish currency has lost 47% of its value this year and 30% in November alone, rapidly eroding Turkish incomes and savings, upsetting the budgets of housewives competing to find some imported medicines.

On Tuesday night, Erdogan defended for the fifth time in two weeks the easing of monetary policy, which most economists describe as reckless. As he said in an interview with the state television channel TRT, there is no “return” from the new policy. “We will see that interest rates will fall significantly and therefore there will be an improvement in exchange rates before the elections,” he added. Elections must be held by mid-2023 at the latest.

“This is a dangerous experiment that Erdogan is trying to do and the market is trying to warn him of the consequences,” said Allspring Global Investments’s investment strategist. “Import prices are likely to rise as the pound falls, exacerbating inflation. Foreign investment may drive away foreign investment, making it harder to finance growth. Bankruptcy risk premiums (CDS) indicate a higher risk of debt.” he added. “Investors are getting more and more nervous. It’s a toxic mixture,” he continued.

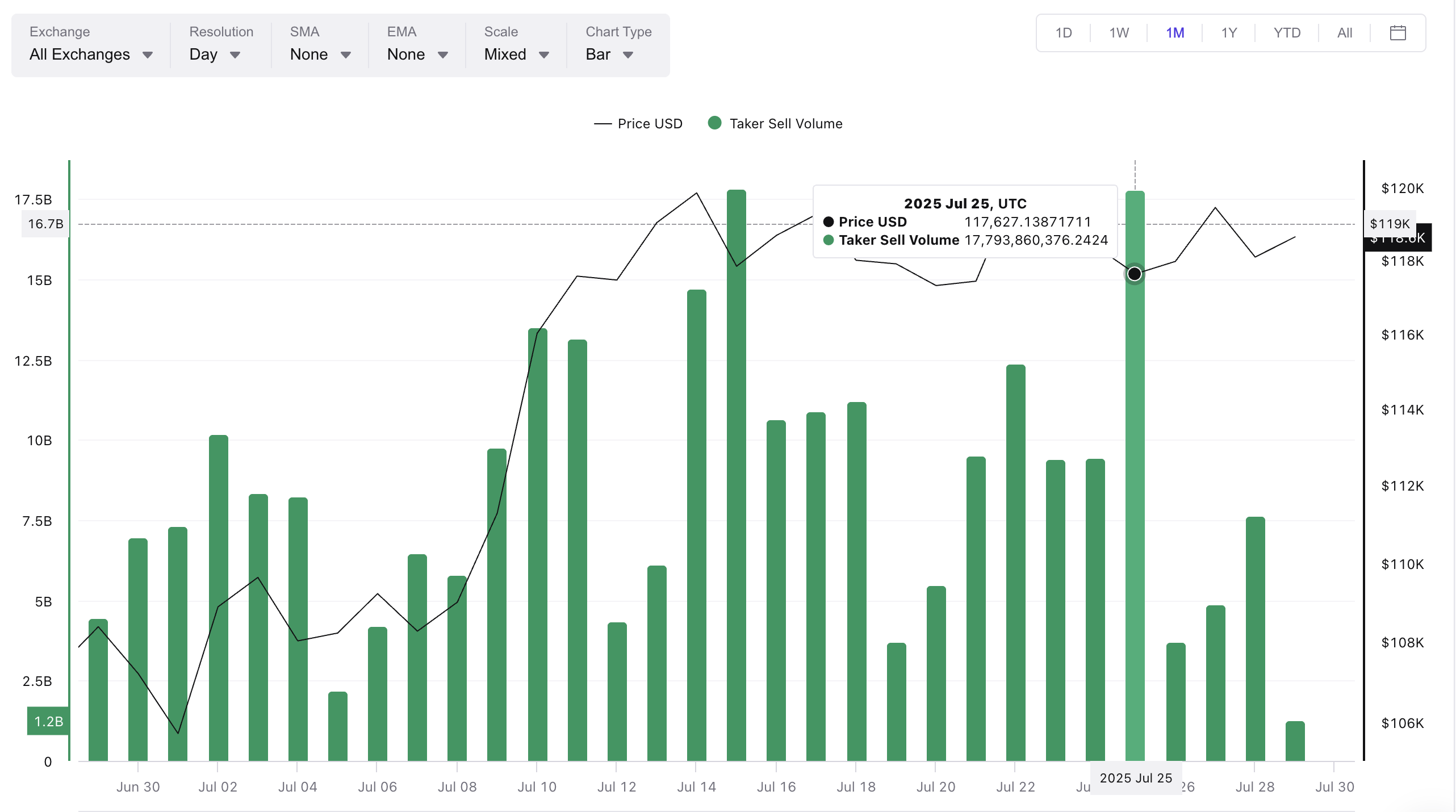

Mass sales of the pound in November were among the largest historically and comparable to those faced by the Turkish economy in the crises of 2018, 2001 and 1994.

Erdogan’s AK Party, which came to power after the 2001 crisis, sees its popular support levels plummeting in opinion polls, which show Erdogan would lose the most likely candidate for the presidency.

Since September, the central bank has cut its key interest rate by 4 percentage points to 15% under pressure from Erdogan, causing real interest rates to be sharply negative, with inflation hovering around 20%. The opposition has called for an immediate reversal of policy and early elections.

Economists note that the devaluation of the pound and the acceleration of inflation – which is projected to reach 30% next year, largely due to the devaluation of the currency – will derail Erdogan’s plan.

Source: AMPE

.

Source From: Capital

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.