The volume of digital transactions in the world is expected to increase by more than 80% by 2025, reaching almost 2 trillion transactions per year. By the end of 2030, that total is expected to nearly triple, according to a survey by consultancy PWC.

The data show that, catalyzed by the Covid-19 pandemic, the digital wallets are gaining more and more space in the routine of individuals around the world.

This is especially true for younger populations: according to data from Grupo Consumoteca, 60% of 18-24 year olds trust digital wallets. That number rises to 70% when looking at Class A.

dematerialization

Digital wallets are electronic devices that allow you to make electronic transactions. It’s a kind of digital version of your bank account and cards, accessible through cell phones, tablets and computers. In this way, they end up replacing the physical wallet — hence its name.

This “dematerialization” of products and services transformed bank payment methods, allowing activities such as making a money transfer, paying a ticket, even saving airline tickets and tickets, to be done through a single application, 100% online.

To win Brazil

This app concept is already trending in countries like China, South Korea and Indonesia. They centralize most of their users’ online activities.

To consolidate its roots here in Brazil, Roberto Kanter, a professor at FGV and specialist in digital transformation of payment methods, believes that the path lies in the formation of partnerships between Brazilian companies.

For the teacher, it is necessary to invest in the technology of this “SuperApp”, aiming to create more amplitude and provide more services to the population.

“The future of SuperApp does not involve verticalization, it necessarily involves co-participation. Without that, there is no such SuperApp,” he stated.

Despite this, the level of acceptance of these products only grows, observing the emergence of the “bankarization” of everything in the country, with the loss of relevance of banks as the final destination of people’s money.

A recent study by Serasa Experian shows that 87% of Brazilians consider digital wallets safe. More than the global perception of 72%.

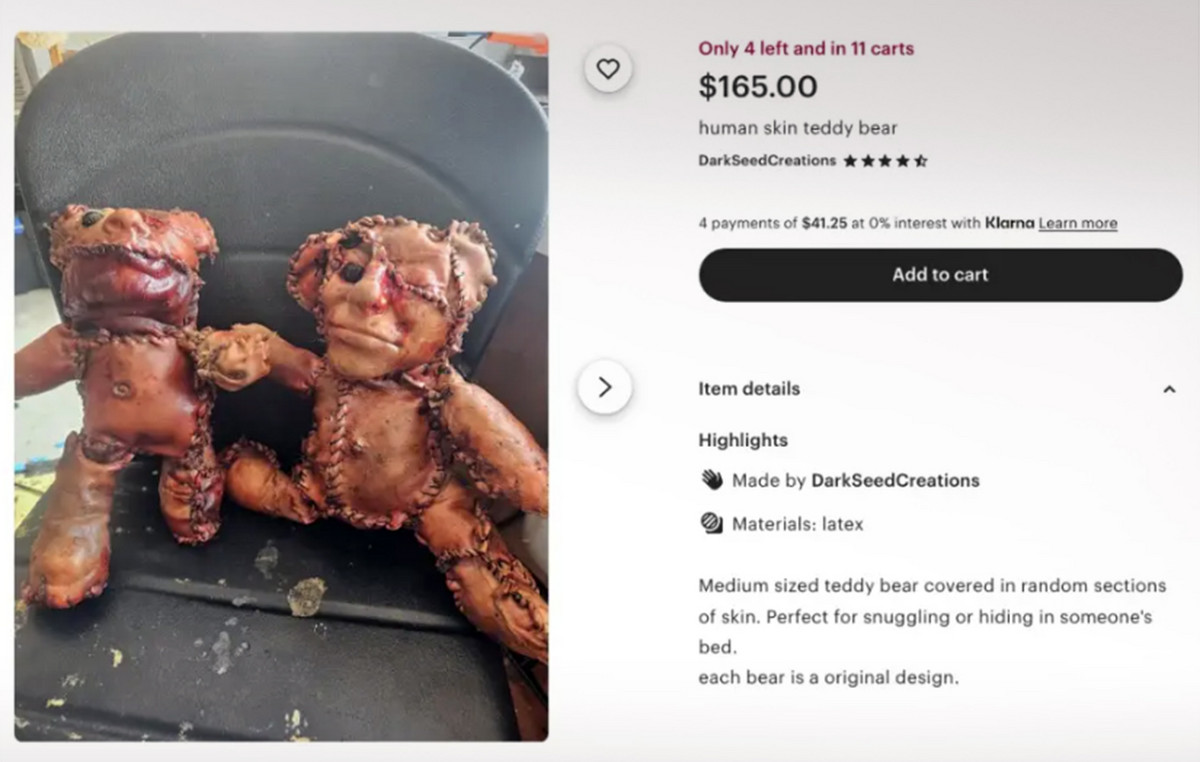

Risks are high

This centralization of services, undeniably practical, does not come without risks: in case of theft or robbery, the threat goes far beyond the device itself.

Marco Zanini, an expert in digital security, points to social engineering as the main cause of digital scams. For him, as these users have no experience in the digital world, there is more vulnerability.

In addition, companies ended up privileging usability. Having a practical and pleasant experience of use ended up overlapping security aspects — in the ease of changing the access password or moving funds, for example.

“Complaints from users themselves make applications safer and more sophisticated,” he explains.

in the episode of CNN Soft Business which airs this Sunday (28), Phelipe Siani also talks to the presenter of Projeto Upload, from CNN Brazil, Stéphanie Fleury. She gives details about the birth of Dimdim, a digital wallet founded by her and bought by Bradesco.

The program airs every Sunday at 11:15 pm. You can check it out on TV and also on YouTube.

Source: CNN Brasil

I am Sophia william, author of World Stock Market. I have a degree in journalism from the University of Missouri and I have worked as a reporter for several news websites. I have a passion for writing and informing people about the latest news and events happening in the world. I strive to be accurate and unbiased in my reporting, and I hope to provide readers with valuable information that they can use to make informed decisions.