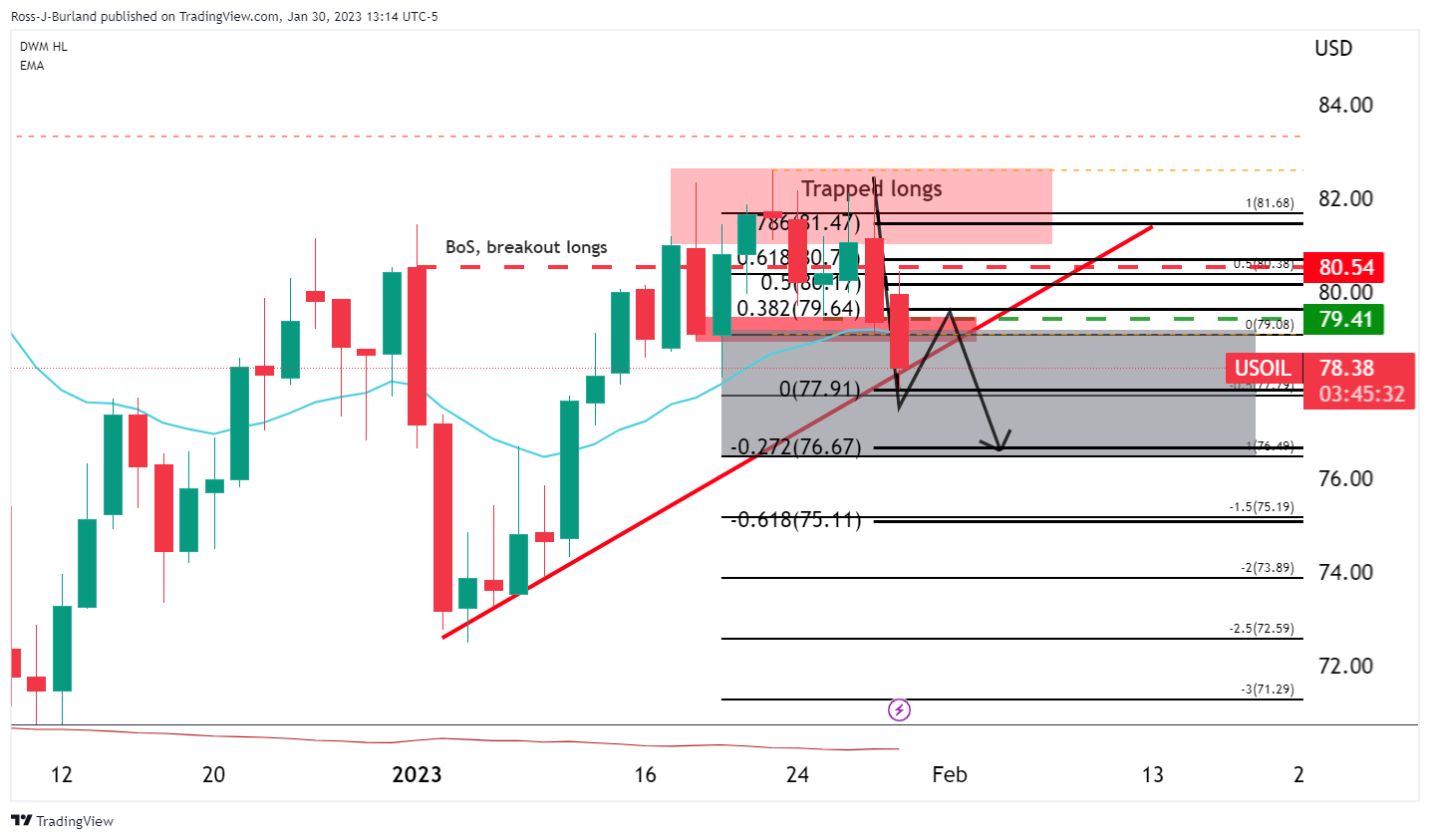

- The longs caught are panicking as the bears take over.

- A 38.2% Fibonacci correction could trigger a new bid.

- A 100% measured target is expected towards $75.00 over the course of the next week:

West Texas Intermediate is down more than 1% on the day and is trading around $78.50 as of this writing after falling from a high of $80.44 and hitting a low of $77.91 so far for the day, ending the a bullish start to the year towards the end of the month and after its first weekly loss last week so far this year,

ANZ Bank analysts say technical factors have come into play as Brent futures have failed to hold above the 100-day moving average. However, “the market remains encouraged by what the reopening of China will mean for demand.”

Fund managers increased their bullish positions in Brent to their highest level in 11 months. Spot prices were again above futures, a sign that demand will outpace supply,” the analysts added, noting that in China ”travel reached 90% of pre-pandemic levels during spring break. Domestic air transport was also up 80% year-on-year last week.”

Meanwhile, prices eased on Monday as investors were wary of the expected hike in US interest rates this week. The Federal Reserve meets and market sentiment that the Fed is going to turn around keeps investors on the sidelines and eager to liquidate positions ahead of the meeting. The Federal Reserve is expected to translate into a 25 basis point hike in US interest rates, keeping recession fears in the crosshairs of investors.

Prices are down despite heightened geopolitical risk in the Middle East following the drone attack on a munitions manufacturing plant in the Iranian city of Isfahan. According to the New York Times, the attack is blamed on Israel.

On the other hand, concerns persist that markets will find it difficult to adjust to European sanctions on petroleum products. TotalEnergies warned that Europe remains at risk of diesel shortages.

Analysts at TD Securities said CTA trend-followers are better positioned in oil products such as heating oil and RBOB gasoline amid an EU ban on importing Russian fuels, though recent selloffs have helped somewhat. to weaken gasoline crack differentials. The analysts explained that “the EU fuel import ban continues to raise uncertainty regarding fuel availability in the coming months, but resilient Russian exports are defying expectations of imminent disruptions,” and that “notwithstanding , new long CTAs could be expected above the $2.62/gal range in gasoline, although CTAs are already approaching their maximum effective length in heating oil.”

WTI Technical Analysis

Meanwhile, New York traders were short on accumulated trapped volume around $79.40/$50. while a massive sell-off occurred in the early hours of trading.

However, with the Fed just around the corner this week, and taking into account the formation of the daily M and the support of the trend line, we could be looking at some consolidation for the next few sessions:

That being said, a correction at resistance could lure trapped longs out of losing or breakeven positions and subsequently shorts entering the market around the 38.2% Fibonacci correction could see a move out of consolidation. below trapped volume and towards a 100% measured target towards $75.00 over the course of the next week:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.