- Index rebounds from multi-month lows after NFP.

- The US economy added more jobs than expected in November.

- A 50 basis point rate hike continues to be favored despite strong payrolls.

The dollar, in terms of the index of USD (DXY)quickly recaptured the area above 105.00 after another good result in the US Non-Farm Payrolls on Friday.

USD Index seems to be supported near 104.40

The index manages to regain strong upward traction following strong printouts from November payrolls, which showed that both job creation and wage growth remained unabated.

In fact, the US economy added 263,000 jobs over the past month (versus 200,000 expected) and the unemployment rate held at 3.7%, while average hourly earnings rose more than expected by 0.6%. month-on-month and 5.1% over the previous year. The Participation Rate, however, deflated slightly to 62.1% (from 62.2%).

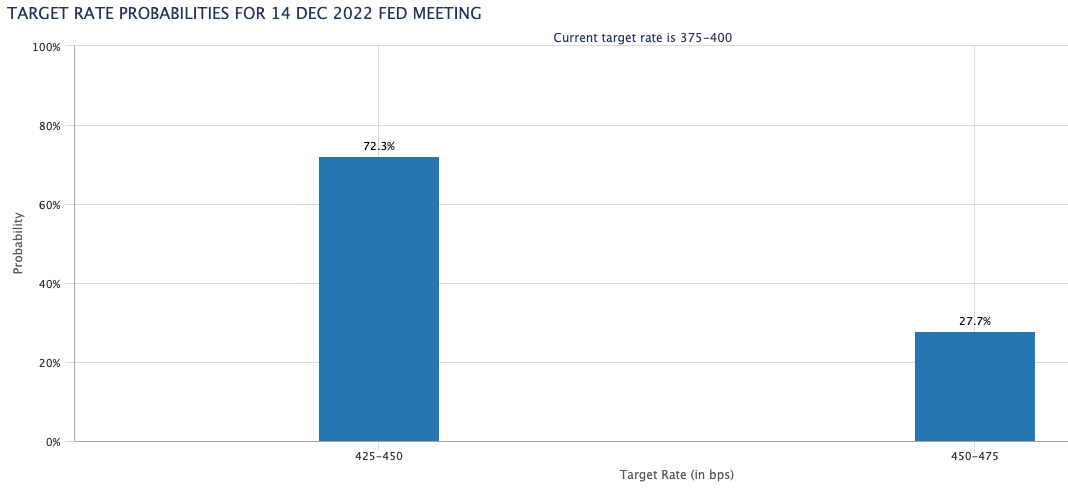

Following the release of the jobs report, the probability of a 75 basis point rate hike at the next Fed meeting (December 14) improved to almost 30%, according to CME Group’s FedWatch tool.

Next on the American agenda is a speech by Chicago Federal Reserve Chairman Charles Evans (2023 voter, centrist).

What to keep in mind around the dollar

The dollar appears to have found some containment around 104.30 for the time being.

While the Fed’s hawkish speech keeps the pivot narrative in the freezer, upcoming results in US fundamentals will likely play a key role in determining the chances of a slower pace of the normalization process. the Fed in the short term.

technical levels

Now, the index gains 0.58% at 105.33 and faces the next upside barrier at 105.55 (200-day SMA), followed by 107.19 (30 Nov weekly high) and then 107.99 (Nov 21 weekly high). On the other hand, a break of 104.37 (weekly low Dec 2) would open the door to 103.41 (weekly low Jun 16) and finally 101.29 (monthly low May 30).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.